This essay is reproduced here as it appeared in the print edition of the original Science for the People magazine. These web-formatted archives are preserved complete with typographical errors and available for reference and educational and activist use. Scanned PDFs of the back issues can be browsed by headline at the website for the 2014 SftP conference held at UMass-Amherst. For more information or to support the project, email sftp.publishing@gmail.com

Agricultural Research and the Penetration of Capital

by Richard Lewontin

‘Science for the People’ Vol. 14, No. 1, January-February 1982, p. 12 — 17

Richard Lewontin is a population geneticist at the Comparative Museum of Natural History at Harvard University. He is a long-time member of The New World Agriculture Group and Science for the People.

Agricultural production in the United States seems to present a difficulty to political economic theory. On the face of it, it seems that an important sphere of production has resisted the usual advance of capitalist penetration. Although ships and shoes are produced by a relatively small number of corporations of very large size and huge capital investment, the production of cabbages has remained firmly in the hands of 2 1⁄2 million petty producers. Why is it that the technological change and concentration of capital that we see in the manufacturing, transportation, extractive industries, etc. has not taken over agricultural production as well? An answer sometimes given is that agriculture has simply lagged behind and that monopoly capitalism is finally catching up with it. Thus, the number of farms is decreasing (from 5.7 million in 1900 to 2.7 million in 1975), the average size of farms is increasing (146 acres in 1900 to 404 acres in 1975), and big enterprises are taking over huge acreages (the proportion of all farms that are over 1000 acres has risen from 0.8% to 5.5% in the same period). This answer does not really meet the facts, however. Of the three million farm operators who disappeared between 1900 and the present, 2 million were tenancies. The proportion of all farms run by managers rather than family units has not changed (less than 1% of farms), and big corporations have actually divested themselves of farm land in recent years. There is simply no rush to make farms into immense General Motors corporations.

Farming vs Agriculture

The basic problem in confronting the analysis of capitalist development in agriculture is the confusion between farming and agriculture. Farming is the process of turning seed, fertilizer, pesticide and water into cattle, potatoes, corn and cotton by using land, machinery and human labor on the farm. Agriculture includes farming, but it also includes all those productive processes that go into making, transporting and selling the seed, machinery and chemicals that the farmer uses, and all of the transportation, food processing and selling that go on from the moment a potato leaves the farm until the moment it enters the consumer’s mouth as a potato chip. Farming is growing peanuts. Agriculture is turning petroleum into peanut butter. It is the claim of this article that capital has completely penetrated agricultural production when viewed as a complete process in the U.S. and that technological change has played the same role in that penetration as it has in all other productive sectors. That is, the owners of large amounts of capital are the ones who control and profit from agriculture. It is a corollary of this claim that agricultural research, although directly responsive to the demands of farmers, is, in fact, carried out on terms set by capital concentration.

Historical Development: Inputs

The most striking change in the nature of agricultural production in the U.S. since the turn of the century is the change in the composition of inputs into farm production. These inputs are the seed, fertilizer, energy, water, land and labor that the farmer uses in production. The total value of these inputs in any year can be calculated by weighting the physical amount of each by its price (adjusted for inflation). This value can then be compared from year to year by establishing some year as an arbitrary base with the index value 100 and expressing all other years relative to it.

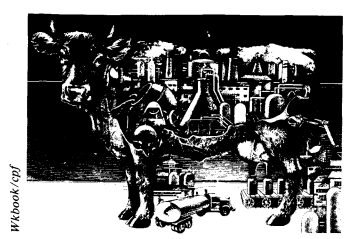

The total amount of inputs into farming rose from an index value of 84 in 1910 to about 100 in 1975, not a very great increase. But the nature of these inputs changed drastically. Inputs produced on the farm itself went from an index value of 175 down to 90 between 1910 and 1975, while the index value of inputs the farmer purchased from outside the farm rose from 38 to 105. That is, farmers used to grow their own seed, raise their own horses and mules, raise the hay the livestock ate, and spread manure from these animals on the land. Now farmers buy their seed from Pioneer Hybrid Seed Co., their “mules” from the Ford Motor Company, the “hay” to feed these “mules” from Exxon, and the “manure” from Union Carbide. Thus, farming has changed from a productive process that originated most of its own inputs and converted them into outputs, to a process that passes materials and energy through from an external supplier to an external buyer.

The consequence of this change can be seen in the sources of the market value of consumer products. At each stage of a productive process, as a raw material is converted to a partly finished form then to a finished product, and then into an item for the consumer some value is added to the material by the labor expended. Iron and coal are cheaper than the steel that is made from them; the steel is cheaper than the girder made from it; and the girders are cheaper than the bridge built from them. At each stage the transformation of form by the labor expended on it adds value, and the total value added is the difference in price between the original raw materials and the final product consumed.

At present, only 10% of the value added in agriculture is actually added on the farm. About 40% of the value is added in creating the inputs (fertilizer, machinery, seeds, hired labor, fuel, pesticides, etc.), and 50% is added in processing, transportation and exchange after the farm commodities leave the farm gate. Another facet of this structure of production is that, although the percent of the labor force engaged in farming has dropped from 40% to 4% since 1900 (a loss of about 4.3 million family workers and about 4 million farm laboreres), there has been a growth in those who supply, service, transport, transform and produce farm inputs and farm outputs so that there are now about 6 persons engaged in off-farm agricultural work for every person working on the farm. To sum up, farm production is now only a small fraction of agricultural production.

Productivity

The second major historical fact concerns the detailed nature of the production process on the farm and of farm productivity. Total farm productivity, measured as the ratio of farm outputs to farm inputs, went from an index value of 53 in 1910 to 113 in 1975. That is, for each dollar spent by the farmer on farm inputs, the value of what the farmer produced more than doubled. It is extremely difficult to estimate total inputs in the 19th century, but labor productivity increased, depending on the crop, by a factor of 2-3. The increase in farm productivity took place in stages corresponding to important technological innovations. The first period, beginning in about 1840 to about the turn of the century, was marked by a tremendous increase in labor productivity because of the introduction of farm machinery. The steel plow, the harvester, the combine and stationary steam engine increased labor productivity in grain production, for example, by up to 8 times in dry regions where full combines could be used. This development in machinery, however, came to a stagnant period around the end of the 19th century because of the lack of traction power. Only small multiple plows could be pulled by horse teams. Stationary steam engines for threshing had to be fed with grain by horse and wagon; rudimentary steam tractors had poor maneuverability. Then, after the first World War, the automotive industry developed flexible, powerful, mobile traction. Internal combustion engines, diesel engines, the differential that allows rear wheels to move independently, and inflatable tires made farm tractors that could pull heavy loads and maneuver in tight places. The final spurt of machinery adoption was between 1937 and 1950.

Chemical Inputs

The third major change was after World War II with the immense growth in chemical inputs into agriculture. This was a consequence of two factors. First, chemical plants had been built at government expense during the war so that chemical companies found themselves with immense unused plant capacity. The price of fertilizer fell dramatically compared with other inputs. Second, export markets increased dramatically because of European demand, so production had to be increased quickly, and fertilizers were the fastest, cheapest way. Chemical inputs to farming increased by a factor of 7 times between 1946 and 1976.

There are three features to note about these technological changes.

1) They were not the product of agricultural research, but of entrepreneurial capitalism. McCormick and Hussey, who invented reaping machines in the 1830’s, were typical inventor entrepreneurs of early industrial capitalism; and the flourishing of the first phase of mechanization was a consequence of industrial capitalism. McCormick was a Virginia farm boy who invented a successful reaping machine in 1831, patented an improved model in 1834, and by 1841 established a large factory for its production in Chicago. The changes in traction power were a direct spinoff of the development of the automobile as the leading American industry, and the fertilizer and pesticide “revolution” was a consequence of the economic structure of the chemical industries and strong export demand.

2) At all times, but especially for mechanization, it is the labor process which is at the heart of the change. Farmers, like other producers, are under a constant pressure to reduce labor costs. The spread of the reaper came 20 years before the famous Civil War labor shortage. But, in addition, farmers are under an unusually strong pressure to control the labor process, not simply to reduce the payroll. A strike by harvest workers results in total loss of the product, not simply postponement of production. Carelessness causes crop loss or damage. But it is very hard to supervise farm labor and to regulate its speed. Therefore, piece work is common in harvesting. But piece work puts a premium on total speed without quality control. Mechanization provides control over speed and quality, as well as guaranteeing production. No strikes, no shortages. In this connection, it is interesting that the early vegetable farming “machines” were simply large horizontal platforms, pulled by a tractor, on which workers lay to tend or harvest the plants. The farmer or foreman drove the tractor. This reverse assembly line in which workers are moved across the work not only reduced the labor force, but also controlled the speed of work and allowed close supervision of the process. It was made possible by Henry Ford.

3) The effect of the technology is to reduce the value added on the farm and increase the value of purchased inputs. That is, the chief consequence of technological innovation to increase on-farm productivity has been to make on-farm productivity less and less important in determining agricultural value. Major changes in all aspects of farming technology are in the same direction. Thus, hybrid seed is a purchased input replacing the older self-generated seed, mechanized irrigation replaces labor-intensive ditching, etc.

It is important to note that all changes in value added on the farm are not the consequence of technological change in agriculture. Changes in factor prices in inputs and processing as a result of technological changes or political changes (oil prices) also change the proportion of value added on the farm.

Agricultural Research

Where does agricultural research fit in? The research carried out by suppliers — seed companies, machinery companies, chemical companies — is clearly designed to maximize the use of purchased inputs. But the same happens in socialized research. Our field studies of agricultural research scientists in state agricultural experiment stations give a consistent picture. Research workers usually come from farm backgrounds or at least small town agricultural service communities. Their ideology is to serve the farmer by making farming more profitable, more risk-free and easier as a way of life. They also say that benefits to the farmer will trickle down to the consumer. In actual practice, most agricultural research is directly responsive to the demands of farmers (what agricultural research scientists call “progressive” farmers, i.e. larger and richer farmers) in the state. But the critical point is that the demands of the farmers are determined by the system of production and marketing in which they are trapped. Thus, the farmer becomes the agent by which the providers of inputs and purchasers of outputs use the socialized establishment of research. Agricultural research serves the needs of capital by responding to the demands of farmers, because of the total control by capital of the chain of agricultural production and marketing.

On the production side the influence is obvious. Farmers buy huge amounts of herbicide to replace cultivation. Weed science departments in schools of agriculture spend their time testing and evaluating herbicide treatment combinations, leaching rates and toxicity. Agricultural enginnering departments design machines for application of herbicides and redesign other machines for weed-free fields. Plant breeders breed varieties for earliness to take advantage of herbicide treatments. In plant breeding the hybrid seed method has become omnipresent because it makes the purchase of seed from a seed company necessary. But, more than that, the objective of the breeding program is to provide varieties that make maximal use of heavy fertilizer application (short, stiff stalks to prevent lodging, proper root development, etc.). All phases of research are directed by the nature of purchased inputs.

On the marketing side the same dependence is evident. Just as the procession of farm inputs — seed, fertilizer, pesticides and machinery — is highly monopolized, so purchase of farm outputs is in the hands of monopoly buyers (monopsonists). Cargill buys grain, Hunt buys tomatoes, and Anderson-Clayton buys cotton. Cargill pays for soybeans based on the regional average protein content. But there is a negative correlation between yield and protein, so it will not pay a farmer to use a higher protein variety with less yield. Therefore, plant breeders go for yield, not protein. Canneries make contracts with farmers which govern all the inputs and require delivery of a particular type of tomato at a particular time. Again, breeders comply with the “demands of the farmers” for just the right tomato.

In summary, because farmers are a small (although essential) part of the production of foods, the conditions of their part of production are set by the monopolistic providers and buyers of farm inputs and outputs. Therefore, the agricultural research establishment, by serving the proximate demands of farmers, is, in fact, a research establishment captured by capital. The farmers are only the messengers. The messages are written in the corporate headquarters.

Who Benefits?

Next, we can ask who benefits. For most of the period since 1930, farm productivity has risen faster than productivity in other sectors of production and much faster than productivity in services, which are a relatively poor sector in productivity. Who has benefitted from this productivity increase?

1) Not the consumer. The average price of food has risen more rapidly than the average of all prices. The ratio of food prices in 1970 to that in 1930 was 2.48. The ratio for all purchased goods and services was 2.33. So food has not become cheaper but relatively more expensive despite a more rapid rise in on-farm productivity! It is very difficult to get reliable information on changes in nutritional levels. Studies are contradictory. The only major change in the last 20 years has been an increase in fat and a decrease in carbohydrate consumption. There has been no long-term change since 1910 in proteins, and the information on calories is contradictory. People are neither eating more, nor are they eating more cheaply.

2) Not the farmer. Total farm debt outstanding in 1910 was $800 per farm. By 1977 it had grown to $37,000. Of this 45-fold increase, only a factor of 3 is accounted for by inflation in the same period. Taking account of the growth in the size of farms, the debt per acre has grown from $3.50 per acre to $91 per acre. This should be weighted against the inflationary change in average market value of farm land of $42/acre in 1910 to $405/acre in 1977. So debt rose from 13% to 23% of the value of real assets. The expense of farm production has gone from 48% of gross receipts in 1910 to 70% at present. Thus, the pressure on farmers and the danger of bankrupcy from variations in price and yield is greatly increased. While the total value of farm real estate has exploded, this is paper value. Farms cannot be liquidated in large numbers, and they have represented a real liability at inheritance because of inheritance tax. Farm risk remains high, hours long. The conditions of farm work for family farmers are better to the degree that driving an air conditioned tractor is better than sweating behind a mule. Net income per operator (in constant dollars) has increased 2.5 times since 1910, but much, if not all of that, is from elimination of the poorest farm sector — tenants and sharecroppers.

3) Input and output capital enterprises. The providers of inputs have become very rich. This is not a direct product of increases in productivity but of the mode of increase of productivity, high capital inputs. Seed companies are making very high profits and have been acquired recently by major chemical companies. Chemical companies producing herbicides, insecticides and fertilizers have realized enormous profits. At this moment, farm machinery providers, like the automotive industry, are in serious financial trouble, as machinery inputs have leveled off and been replaced by chemical inputs. On the marketing side, there has been a tremendous growth of grain and transportation companies, food processing industries and supermarket chains, all of which have acquired very great capital since World War II. This is the sector that has clearly gained from productivity changes and accounts for the slippage between increases in farm gate productivity and increases in relative cost of food to the consumer.

HYBRID CORNHybrid corn is a striking example of how inputs that used to be produced by farmers themselves, are now purchased. In the 1930’s, corn was harvested by hand, and farmers obtained the seed they needed for the next year’s crop by picking out good looking ears during the harvest, and saving them for seed. Increasingly, beginning in the early 30’s, this self-produced seed has been replaced by hybrid corn, the seed for which must be purchased from a seed company every year. Hybrid corn (or any hybrid crop or livestock) is produced in four stages. First, corn strains are self-pollinated generation after generation to produce so-called inbred lines that are each genetically very homogenous, yet different from each other. Second, different inbred lines are crossed with each other in all combinations to look for a hybrid combination that has higher yield than the average. Third, the inbred lines that went into superior hybrids are grown in large numbers to make enough plants for seed production. Finally, the lines are crossed in massive numbers to produce the seed for sale. All of these steps need special isolation fields, lots of skilled labor and some scientific knowledge. No farmer can afford to make his or her own hybrid corn seed, so he or she must buy it from the seed company. Moreover, the farmer must buy it anew every year because the hybrids, if allowed to reproduce, do not breed true. Seed harvested from them in the farmer’s field, will not produce such high yields as the original hybrids. In actuality, seed companies do not carry out the first two stages of this operation themselves. They depend on state agricultural experiment stations, funded at public expense, to find the best inbred lines. Then, the companies take the lines and make the seed and the profit. Most of the hybrid corn seed now used in the corn belt, produced by four different seed companies, derives from a Missouri and an Iowa inbred line developed by the state experiment stations. Farmers started to use hybrid corn because it gave an initial increase in yield over the open-pollinated varieties that farmers themselves had been propagating. Since the 1930’s, immense effort has been put into getting better and better hybrids. Virtually no one has tried to improve the open-pollinated varieties, although scientific evidence shows that if the same effort had been put into such varieties, they would be as good or better than hybrids by now. On the contrary, there has been pressure by seed companies to produce hybrid soybeans, hybrid chickens, hybrid cattle, etc., and to convince farmers that these hybrids will be better. Cargill and Northrup-King, to name two, have spent millions in an attempt to make hybrid wheat that is superior to the usual varieties. They have not yet succeeded, but if they do, millions will be made in annual sales of wheat seed, whereas now, farmers need to go back to the seed companies only every 3-5 years to get new seed. |

Why Corporations Do Not Own Farms

Finally, we may ask why capital penetration in agriculture has taken the particualr form it has, with monopolistic supply of inputs to, and monopsonistic purchases of outputs from, a vast petty producing population of farm entrepreneurs. Why has capital not taken over the farms themselves?

1) Purchase of farm land ties up huge amounts of capital which has low liquidity, no depreciation value for tax purposes, uncertain market price, and produces a low return on investment.

2) Farming is physically extensive so it is not possible to bring large numbers of workers and productive processes together in a small space.

3) Related to 2, the labor process is difficult to supervise and control.

4) The turnover rate of capital is limited by the annual cycle of growth, and this cycle becomes even longer in the case of large livestock.

The test of these assertions is in the exceptional cases such as poultry production which is vertically integrated by large capital entrepreneurs. Vertical integration means that the same corporation operates at every level of production. The same firm produces many of the inputs, does the breeding, grows the birds, slaughters and processes them, and sells them en masse to fast food chains and supermarkets. Poultry takes little space, lends itself to factory organization of production with capital equipment that is depreciable and an easily supervised labor process. Moreover, the cycle of capital does not depend on an annual growth cycle in broilers and can be compressed further and further. Indeed, a main focus of poultry breeding is shortening of the growth period, even holding total feed consumed a constant.

Farmers are, then, a unique sector of petty producers who own some of the means of production, but whose conditions of production are completely controlled by suppliers of inputs and purchasers of outputs. They form the modern equivalent of the “putting out” system of the pre-factory era. They are the conduits through which the benefits of the agricultural research enterprise flow to the large concentrations of capital. Because of the physical nature of farming and the structure of capitalist production and investment, this is a stable situation in capitalism and must be understood not as an exception to the rule of capital but as one of its forms.

>> Back to Vol. 14, No. 1 <<