This essay is reproduced here as it appeared in the print edition of the original Science for the People magazine. These web-formatted archives are preserved complete with typographical errors and available for reference and educational and activist use. Scanned PDFs of the back issues can be browsed by headline at the website for the 2014 SftP conference held at UMass-Amherst. For more information or to support the project, email sftp.publishing@gmail.com

The Dollars and Cents of Nuclear Power

by Joe Bowring, Nancy Folbre, Don Michak, & Tom Harris

‘Science for the People’ Vol. 10, No. 5, September/October 1978, p. 12–18

Introduction

The large corporations of the nuclear power industry have made their choice. They have invested a great deal of money in nuclear power in the hope of high profits, and they are using their vast economic power in an attempt to ensure that these hopes are realized.1 In the late 1960s it looked as if these corporations would be successful, but they have suffered a series of setbacks which now threaten to stop nuclear’s advance altogether.

The problems confronting the nuclear plan are substantial. Utilities have encountered financial difficulties which inhibit their ability to build nuclear plants. The simple costs of nuclear power have risen dramatically despite large federal subsidies, and the economic uncertainties facing its implementation have grown.

The nuclear corporations have not given up yet. Their proposed solution is in the best tradition of big U.S. corporations faced with disaster: use the federal government to cut their risks. They want continued federal subsidies, continued federal responsibility for critical parts of the fuel cycle, and new federal action to guarantee future profits. Taxpayers will pick up the bill, and everyone will bear the risks.

Nuclear manufacturers push nuclear power for the simple reason that it is good for profits. For the utilities the case is not as clear. Utilities have not been buying nuclear reactors. However, many of them continue to lobby for nuclear power even while cutting back on their orders for plants.

Capital Intensive Growth

The sixties were a boom for the economy in general and for the electrical utility industry in particular. Demand for electricity was expanding at a steady rate of about 7% a year, and investors were eager to supply the capital for new nuclear plants.

Growth created expectations of continued growth which were essential to investors in stock, and the growth in earnings and profits maintained the good financial position of utilities in general. These conditions created a bias toward capital intensive growth by these regulated utilities.

As regulated monopolies, utilities are allowed a rate of profit which is set by the regulatory commissions. It is not a rate of profit on all their costs, however. It is a rate of profit on their capital or “rate base.” This rate base consists principally of plant and equipment like the buildings, boilers, and reactors which are required for generating power. The regulatory commission approves a rate structure which will allow the company to pay for such expenses as maintenance and fuel, and to earn the allowed rate of profit on its capital.

This arrangement creates a bias towards capital intensity in the following way. When a particular item is included in a utility’s rate base, the utility can recover that amount plus its rate of profit on it. If the item is not included in the rate base, the utility can recover only the amount spent. As a result, when a utility has a choice it will attempt to include as many of its costs as possible in the rate base so as to maximize its total profit.

It is this desire to maximize the size of the rate base – and thereby to maximize profits – which affects a utility’s choice between a coal plant and a nuclear plant. There is a clear difference between the cost structure of a coal-fired plant and a nuclear powered one. For coal plants, fuel accounts for a much higher percentage of cost, while for nukes, a much higher percentage is capital cost. Fuel costs are not included in the rate base while capital costs are.

Nuclear power was on the rise. Between 1965 and 1977 the generating capacity of nuclear plants, which reflects plants ordered in the late sixties and before, grew from 926 Mw to 47,000 Mw, or from an insignificant proportion of the nation’s net generating capacity to about 9%. Cheap capital and high demand for electricity combined to make nuclear power an attractive option for profit-maximizing utilities and their stockholders.

The 1970s

This nuclear euphoria didn’t last long. The fortunes of the utilities worsened dramatically in the early 1970s along with the rest of the economy. The underlying problems of inflation and recession meant financial strain for the utilities. The weakened utilities could not continue to invest at the levels to which they were accustomed. A major part of the problem confronting utilities was simply rising costs. The effect was to reverse the long-term decline in the cost of producing a unit of electricity and to end the stable or declining prices that electricity users enjoyed during the 1960s. These rising prices combined with the general recession to produce a dramatic decline in the demand for electricity.

As a result, it became very expensive to raise new capital. Just when many utilities had committed themselves to large construction projects, they were no longer able to afford them. In many cases they also no longer needed the added capacity. Where capacity was still needed, fossil fuel plants were easier for utilities to finance when capital was expensive precisely because they were less capital intensive. In order to meet the capital requirements of a nuclear plant, rate increases were required, while for fossil plants a substantial portion of the cost could be passed on to the customer via the already-established fuel adjustment clause.

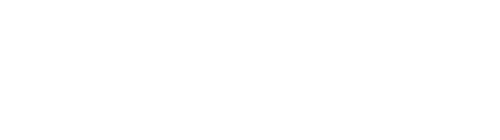

The response from utilities was a drastic scaling down of all construction projects. Nuclear was especially hard hit. In 1974 about 170,000 Mw out of a planned 360,000 Mw of new plants were cancelled or delayed. Nuclear plants accounted for almost two-thirds of the cancellations. Orders for nuclear plants fell from a peak of 35 in 1973 to 3 in 1976 and 4 in 1977. Electrical World was forced to admit in 1977 that “almost all future nuclear additions have been rescheduled.” The magic cycle of growth and cheap capital had been broken, and at least some of the pro-nuclear bias went with it.

Cost: Construction and Reliability

Estimates of the cost per kilowatt for every method of electricity generation have risen substantially in the last two years. The most important elements in the overall cost increases for nuclear power are the rising cost of construction and operation, and low capacity factors.

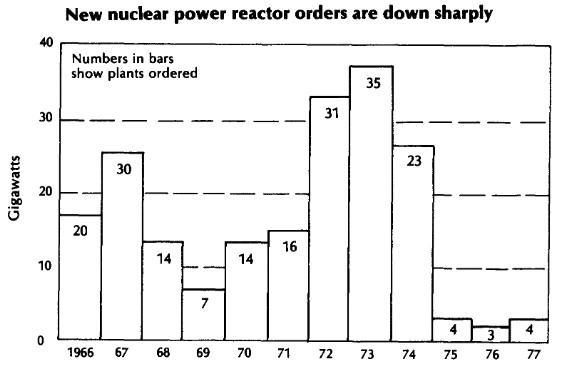

The actual construction of a plant, including the cost of financing construction is termed the capital cost. It has always been recognized that nukes have higher capital costs than coal plants, but in general, estimates of nuclear plant cost have proved too low by a factor of between two and three.

Typically, Northeast Utilities’ Millstone Point Two plant, originally budgeted at $186 million, had cost $418 million when finally completed.

The high capital cost of nuclear power plants is proving to be a substantial barrier to their construction. Capital costs, unlike fuel costs, must be paid for whether or not a plant is operating at its design capacity. If a plant is generating below its design capacity or is shut down for any reason, then the capital cost per kilowatt actually generated rises correspondingly.

Early in 1974 economist David Corney found a serious bias in Atomic Energy Commission estimates of the relative costs of coal and nuclear. A.E.C. estimates assumed that both nuclear and coal plants operated at 80% of their design capacity. Yet Corney showed that nuclear power plants had not been able to generate much more than half the electricity they were designed to produce. When the A.E.C. projections were adjusted to conform to these actual capacity factors, nuclear-generated power proved to be far more expensive than had been expected.

The low reliability of nuclear generators significantly increases the cost of their operation. Reactor malfunctions are not small problems. Because of radioactive hazards, the cost of repairs or service to nuclear plants can be enormous. Work that would be trivial in other circumstances can take a great deal of time. Quite often, when utilities are forced to shut down their nuclear plants they must buy electricity from other utilities at premium rates. These costs of poor reliability, which are unique to nuclear plants, are highly variable and difficult to predict.

The major variable cost of nuclear reactor operation is that of fuel. Principally, because of the exceptionally high heat content of uranium, the direct cost of fuel is now responsible for only about 13% of the cost of nuclear power. The price of coal accounts for about 37% of the cost of coal-fired electricity. For this reason, fuel price escalation has less impact on the cost of nuclear electricity. However, the cost of uranium has been and continues to be subject to unexpected price rises.

Nuclear fuel cost will be more significant in the future. In the late 1960s most expectations were that uranium prices would remain near $4 per pound. Those days are long gone, in large part because of price-fixing by the uranium cartel. Bids for 1980 uranium ore are already near $52 per pound. Moreover, experience has shown that nuclear fuel produces much less electricity per pound than was originally projected.

Federal Subsidies

Estimates of the simple costs of nuclear power don’t tell the whole story. Taxpayers have made enormous contributions to the nuclear power industry through a number of direct and indirect subsidies. Many of these subsidies, such as the government guarantees which diminish investment risk, cannot be measured. Others can be roughly quantified through an analysis of government budgets.

Taxpayers provided the funds for the extensive research and development required to apply nuclear technology to electricity generation. The Investor Responsibility Research Center has estimated that, by January 1975, about $5 billion had been provided by the federal government for the development of civilian nuclear power.

One way to get a perspective on the size of current subsidies of civilian nuclear power is to compare them to other areas of government spending. Such budget comparisons reveal seriously misplaced priorities. The most troublesome aspect of the use of coal for fuel lies in the deplorable working conditions of United States coal miners. However, the entire budget of the Mining Enforcement and Safety Administration of the Department of the Interior, the federal agency responsible for mining safety, is set at only $106 million for 1978, about one tenth of the subsidy for uranium enrichment alone. The entire Occupational Safety and Health Administration was granted only $130 million in 1977, less than one-half the money spent on nuclear fuel cycle research and development.

The nuclear industry would never have gotten off the ground without the passage of the Price-Anderson Act. This piece of legislation simultaneously limited the industry’s liability for nuclear accidents and arranged for the federal government (again, the taxpayers) to share the costs. The Price-Anderson Act limits utility liability to $560 million, of which $100 million is insured by the federal government. This amount, $560 million, is less than 11% of the potential damage from a major nuclear accident. The NRC has recently conceded that a major nuclear accident could cause $40.5 billion in total damages. Former Pennsylvania insurance commissioner Herbert Denenberg has calculated that if insurance companies were willing to cover the risk, the premium required to insure a nuclear plant against such levels of damage would be about $23.5 million a year (a figure approximately equivalent to the entire current costs of plant operation and maintenance). If this subsidy were eliminated, the price of nuclear-generated electricity could rise as much as 3.8 mills per kwh. The Price-Anderson Act has been found unconstitutional in U.S. District Court. In the suit still on appeal, Duke Power Company has argued that, “without protection of the liability limit, investors would be unwilling to risk money in a power company, because of the possibility that claims from a nuclear accident could bankrupt them.”2

The typical delivered residential rate for nuclear generated electricity was 4c per kwh in 1976. A conservative appraisal of the true cost, including the subsidies estimated above, is about 5c per kwh.

| Actual rate | 4.0c |

| Enrichment | .1c |

| Research and development | .7c |

| Insurance | .4c |

| per kwh 5.2c |

Expressed in pennies, it may not sound like much. Read it, instead, as a 25% increase in the monthly electric bill for customers of nuclear-powered electric utilities. Such an increase in price actually charged would have made and still could make alternative energy strategies look considerably more attractive. By providing subsidies to the nuclear fuel cycle, the U.S. government is in fact choosing nuclear power over alternative methods of meeting our energy needs.

Fuel Supplies and Reprocessing

Coal exists in the U.S. in amounts sufficient to meet projected demands for several hundred years: the adequacy of domestic uranium supplies, on the other hand, is questionable. The probable reserves will be used up by plants now operating or now in the planning stages.

Little of the potential heat value of a reactor’s fuel supply is actually consumed before the fuel becomes so contaminated with reaction products that fission becomes inefficient and the fuel rod must be removed. From the beginning of the atomic era proponents of nuclear power have predicted that fuel supplies could be made to last almost indefinitely by extracting, or reprocessing, the unconsumed uranium in used fuel. There now seems little chance that such hopes will be realized.

The history of the fuel reprocessing industry is replete with financial disasters. In West Valley, New York, a subsidiary of the Getty Oil Company, Nuclear Fuel Services, convinced the state of New York to join it in a commercial reprocessing venture. (Considerable pressure for the plant came from the avidly pro-nuclear Governor Nelson Rockefeller.) The plant proved both dangerous and unprofitable; it was shut down after a few years. The only problem was that a lot of radioactive waste was left over, and proper disposal of it could cost up to $660 million. Luckily for the company, their contract allowed them to leave the task and expense of cleaning up to New York State.

Waste Storage

Technical and political problems in the storage of radioactive wastes persist. Many scientists believe that no genuinely safe method of storage is feasible. Serious leaks have already occurred in storage areas at Hanford, Washington, West Valley, New York, and Maxey Flats, Kentucky. Even temporary storage areas are in short supply. The nuclear power industry has openly acknowledged that it will run out of temporary spent fuel storage capacity by 1985.

Decommissioning

A nuclear power plant which has outlived its usefulness is the largest radioactive waste of all. Most industry estimates of the cost of completely dismantling nuclear plants fall between 10% and 15% of the cost of construction (in constant dollars). The lack of experience with decommissioning casts some doubt on the accuracy of these estimates. In at least one case, the cost of decommissioning actually equalled the cost of construction. No private utilities have set aside the capital required to decommission any plants. As Tom Wicker has pointed out, “In effect, future taxpayers will have to pay for current industry profits and relatively low consumer rates.”

In addition, utilities can’t be certain when they begin construction that 10 to 12 years later they’ll end up with a functioning power plant. Plants have been stopped and shut down for design faults, siting errors, and inadequate waste disposal plans. As safer technology is adopted, plants already in operation frequently have to be shut down so that the latest design can be built in (retrofitting).

Much of the difficulty in determining the costs of nuclear power has political roots. Many of these costs depend on a regulatory process which continues to be subject to political pressure. Opponents of nuclear power won a legal victory in 1971 (Calvert Cliffs decision) when they made filing of a detailed environmental impact statement a requirement for new construction. Pressure brought on the AEC led to new regulations in 1971 which restricted radiation emissions to a level “as low as practicable.” Citizen resistance has forced rejection of a variety of faulty waste disposal plants. And, the state of California, in another example, has passed a law prohibiting the construction of new plants until an adequate waste storage plan is provided.

Summary

The simple costs of nuclear power have been rising dramatically. High costs of construction combined with low capacity factors and poor reliability have wiped out the cost advantage that nuclear once enjoyed.

The true cost of nuclear is substantially higher than the simple cost. The cost competitiveness depends on federal subsidies that ultimately come out of the pockets of taxpayers. If these subsidies were removed, the cost of nuclear would increase by 25%.

Utilities’ difficulties in raising capital combined with rising costs have made it increasingly hard for utilities to build capital intensive nuclear power plants. In addition, political pressures on regulatory commissions have prevented the utilities from getting the huge rate increases that would be needed if they are to build more nukes.

These cost and financing problems have slowed the purchase of nuclear plants. Growing uncertainty about how high future costs will go has brought new construction to a virtual standstill. This uncertainty includes the cost of waste disposal as well as the final design and cost of the plants themselves.

Much of the uncertainty derives from political opposition which has already forced the industry to pay some costs which it wants the public to bear. The nuclear industry can’t be sure that it won’t have to pay even more of the cost in the future. The public’s opposition to paying both simple costs and subsidies and to bearing the uncalculated health and safety risks of nuclear power could eventually force the nuclear industry to pay all the real costs of nuclear development. This would destroy nuclear’s current artificial cost competitiveness and mean an end to its economic viability.

The final outcome is far from clear, but what is certain is that it won’t be settled by simple economic forces alone. The costs of nuclear development are high. The revival of profitable nuclear power depends on shifting these costs and risks to the public. In the end, growing public resistance to bearing these costs and risks could stop nuclear’s advance.

Joe Bowring, Nancy Folbre, Don Michak, and Tom Harris are members of the Energy Research Group, based in Amherst, Massachusetts. This article is taken from a section on economics and nuclear power which they wrote for the forthcoming book, No Nukes: Everyone’s Guide to Nuclear Power, by Anna Giorgy and friends, to be published by South End Press, Box 68, Astor Station, Boston, M A 02123.

>> Back to Vol. 10, No. 5 <<

Notes

- The nuclear industry is concentrated in a few corporate hands: two companies, Westinghouse and General Electric, have received twothirds of all orders for nuclear power plants. Three firms divide 75% of nuclear construction. Plans for future nuclear power plants call for about a $100 billion investment.

- The Supreme Court has upheld the constitutionality of the PriceAnderson Act in a recent decision.